- OUR STRATEGY

OUR AIM

Our aim is to preserve wealth by delivering a high-end portfolio. We intend to build strong investment portfolios through utilizing our talent and expertise.

We strategize after thorough research and investing primarily in equity, derivatives, and debt in emerging and non-emerging markets.

INVESTMENT OBJECTIVE

We at Calypso make it our mission to integrate profitable strategies and provide superior investment opportunities. Our unparalleled research capabilities stack the odds in the favour of our client. We provide breakthrough solutions by synergizing technology, innovation and experience. Besides, the Investment Manager has full discretion to invest the Fund’s assets in a variety of securities as defined under the Securities Act 2005, including equities, notes, promissory notes and bonds and shares in other investment vehicles and unlisted companies. The Fund may also undertake arbitrage activity as deemed fit by the Investment Committee.

PORTFOLIO SPOTLIGHT

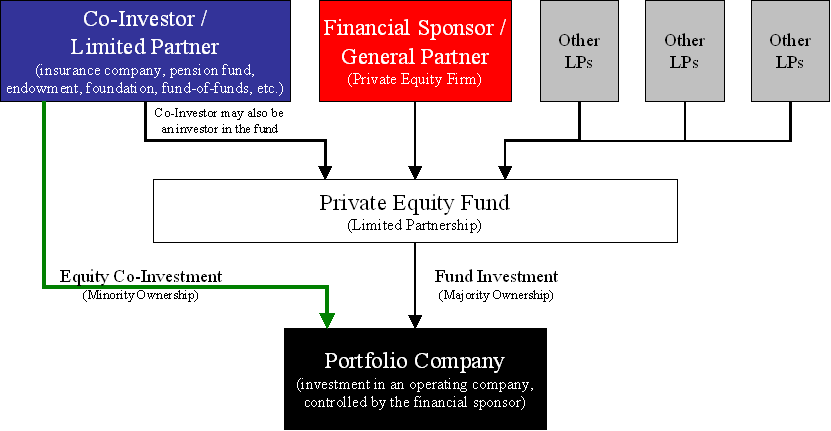

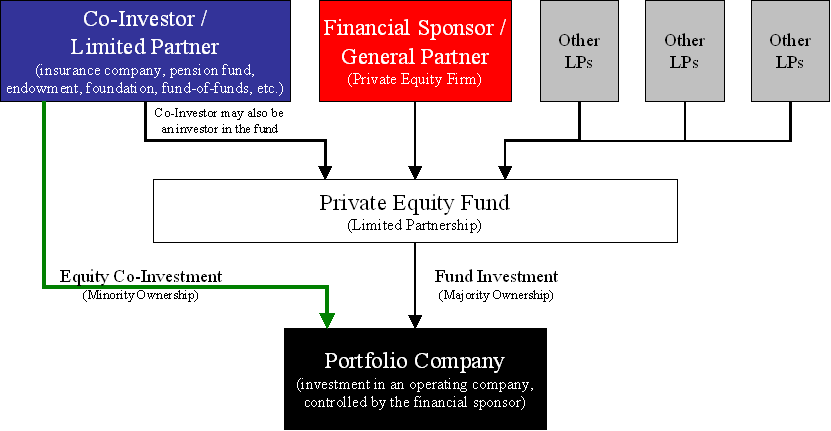

An equity co-investment is a minority investment made by a co-investor into a company.

Real Assets is an investment asset that has an intrinsic worth due to their substance and properties. It covers investments in physical assets such as real estate, energy, and infrastructure.

Real assets have an inherent physical worth and differ from financial assets. As real assets often move in opposite directions to financial assets like stocks or bonds, we provide portfolio diversification.

HNIs banking with private banks rely on their personal capacity to find, invest, hold and monitor the investment. Calypso Global bridges that gap for HNIs by identifying, evaluating, investing and holding Real Assets.

Every individual is unique, therefore a one size fits all approach of big institutions may not be the best solution for all HNIs. Actual risk and perception of risk has traditionally been a point of disconnect in the minds of the investor.

All the models of portfolio management that exist of weightage and exposure to different markets are also no longer as relevant. In light of the above we provide to the client a risk adjusted portfolio that is relevant to his age, risk appetite and geography that the client comes from and understands.

- Arbitrage: There is always an opportunity that exists for arbitrage in different asset classes and we have been running different strategies in our funds with a high degree of effectiveness. Our strategies focus on market anomalies and we always maintain a net zero position on the underlying assets.

- Private equity: With a focus on the Middle East and India, we have made and exited private equity investments in technology and retail space though our fund and we continue to do so.

PORTFOLIO SPOTLIGHT

An equity co-investment is a minority investment made by a co-investor into a company.

Real Assets is an investment asset that has an intrinsic worth due to their substance and properties. It covers investments in physical assets such as real estate, energy, and infrastructure.

Real assets have an inherent physical worth and differ from financial assets. As real assets often move in opposite directions to financial assets like stocks or bonds, we provide portfolio diversification.

HNIs banking with private banks rely on their personal capacity to find, invest, hold and monitor the investment. Calypso Global bridges that gap for HNIs by identifying, evaluating, investing and holding Real Assets.

Every individual is unique, therefore a one size fits all approach of big institutions may not be the best solution for all HNIs. Actual risk and perception of risk has traditionally been a point of disconnect in the minds of the investor.

All the models of portfolio management that exist of weightage and exposure to different markets are also no longer as relevant. In light of the above we provide to the client a risk adjusted portfolio that is relevant to his age, risk appetite and geography that the client comes from and understands.

- Arbitrage: There is always an opportunity that exists for arbitrage in different asset classes and we have been running different strategies in our funds with a high degree of effectiveness. Our strategies focus on market anomalies and we always maintain a net zero position on the underlying assets.

- Private equity: With a focus on the Middle East and India, we have made and exited private equity investments in technology and retail space though our fund and we continue to do so.